Below are some accepted installment centers: Life, Safer Interlock Intoxalock Do not remove the mounted device before your suspension duration as it will certainly need you to begin the suspension over once more - motor vehicle safety.

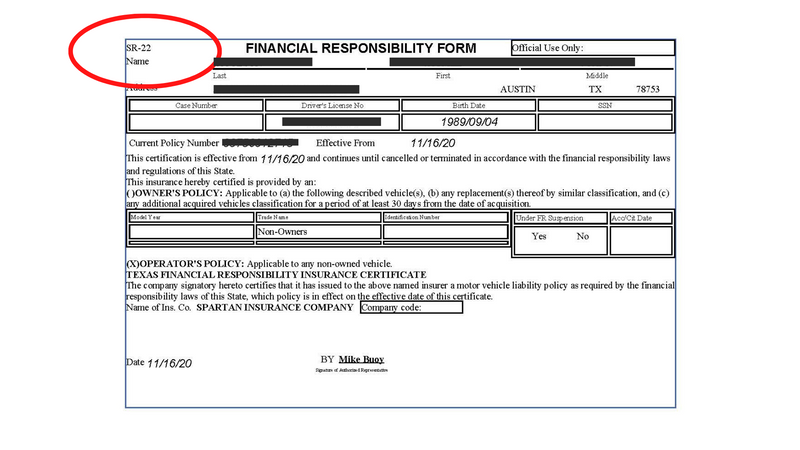

What is an SR-22? An SR-22 is a certificate of economic responsibility required for some drivers by their state or court order. An SR-22 is not an actual "type" of insurance, but a form filed with your state. This type acts as proof your vehicle insurance coverage satisfies the minimal responsibility coverage required by state legislation.

Not everyone needs an SR-22/ FR-44.: DUI sentences Reckless driving Crashes caused by uninsured chauffeurs If you need an SR-22/ FR-44, the courts or your state Electric motor Car Department will certainly alert you.

Is there a cost connected with an SR-22/ FR-44? This is an one-time charge you should pay when we file the SR-22/ FR-44. sr-22 insurance.

A declaring cost is billed for each and every specific SR-22/ FR-44 we file. For instance, if your spouse gets on your plan and also both of you need an SR-22/ FR-44, after that the declaring cost will be charged twice - sr-22. Please note: The cost is not consisted of in the price quote due to the fact that the filing charge can vary.

Your SR-22/ FR-44 must be valid as long as your insurance coverage plan is active. car insurance. If your insurance policy is canceled while you're still required to carry an SR-22/ FR-44, we are needed to alert the proper state authorities.

Facts About How Much Is Sr22 Insurance In Washington State? - Car And ... Uncovered

Below are some means that you can stop needing SR22 insurance policy. Don't drink as well as drive.

If you have already had a DUI or DWI, ensure you find accountable ways to enjoy when driving that DO NOT include alcohol. Do not drive without insurance policy. This is not just high-risk for you but also for various other vehicle drivers when driving. Pay your tickets and also penalties so that your chauffeurs certificate is not withdrawed.

You may also need to go to traffic college. This is constantly a much better option than having your vehicle drivers accredit taken away. Avoid reckless driving. This might imply auto racing, driving illegally, road rage as well as a huge selection of other things. You need to obey web traffic laws as well as try to drive as safely as possible.

Always have you evidence of insurance and also automobile enrollment offered. It is unlawful to not have proof of insurance policy while driving - vehicle insurance. Here are the states that do not need SR22: Also if these states do not need this declaring, you need to keep SR22 insurance coverage if you are transferring to a state that needs it.

When you make the proper options, documents for SR22 as well as keep a great driving document, you will certainly when again get your life back on track. The charge for this declaring is typically under $50.

You will need this insurance for 3 years. Also though this could cost you extra, ultimately, you will certainly be pleased to recognize that your SR22 insurance can be dropped as well as you can continue as a regular driver. A DUI however does occupy to 10 years to leave your record (deductibles).

The Best Guide To Sr22 Filing As Low As $10 A Month! . Low Cost California Sr22 ...

You are going to be really satisfied. It is constantly good to recognize that SR22 is not such as normal vehicle insurance coverage. That is a certification for Division of Electric Motor Cars that you are able to carry routine car insurance for your car. Therefore not every vehicle insurance provider is able to aid you with SR22.

We see to it that all plans are appropriately filed as well as preserved. The most common reason for SR22 insurance coverage in The golden state is to renew vehicle driver's certificate. Nowadays a cars and truck belongs of our lives. Life can become a headache without having legal capacity to drive. Below is a full listing of reasons for SR22 demand in The golden state: DUI (Driving drunk of alcohol) DWI (Driving while intoxicated) Captured on driving without vehicle insurance - insurance group.

In California SR22 insurance policy is mandated for 3 year duration. In instance you stop working to preserve your policy you will certainly be called for to start over.

Your age young drivers under age of 25 have greater expenses for insurance costs. Drivers at the age of 55+ will certainly have relatively reduced prices.

They are much more liable than those that are currently single. In other words, wed individual will certainly more than likely obtain better prices then unmarried with exact same profile. Sex based on criminal statistics across the United States, men are more probable to violate website traffic legislations. That is why males will certainly have a little greater rates on insurance coverage.

Higher performance autos are also more pricey on repair services as well as solution. Stats are likewise showing that there is higher possibility of mishap when driving cars. Credit report poor background with financial institutions can result in higher insurance coverage prices. SR22 is everything about the capacity to maintain your insurance policy status during needed duration.

The Only Guide to Sr-22 Insurance - Safeauto

Select Insurance Group is capable to provide prices even less then $15/month. This results from the fact that we go shopping numerous sources to provide budget-friendly prices to our clients. underinsured. Pretty typically we have price cut programs. The most effective means to examine if you are qualified is to fill up out our quote form.

When authorized you will certainly receive a letter from the DMV specifying they have actually gotten your automobile insurance with type SR22. Maintain this insurance coverage for a minimum of 3 years or your court-ordered suspension duration (insurance companies). Do not allow this plan gap as your permit will be suspended again as well as the period will certainly begin again.

If you're in difficulty in California due to being uninsured in a wreckage or obtaining a DRUNK DRIVING, you could be required to show you have car insurance with a form called an SR-22 - insurance coverage. An SR-22 is a certificate, referred to as a The golden state Insurance Coverage Proof Certificate, that your insurance provider documents with the California Department of Motor Automobiles.

See what you can minimize automobile insurance, Easily contrast personalized rates to see just how much changing auto insurance can save you. If you don't get an SR-22 after a significant violation, you could shed your driving benefits. dui. Below's why you might require one and how to discover the most inexpensive insurance prices if you do.

Exactly how to obtain an SR-22 in The Golden State, Filing an SR-22 isn't something you do by yourself. The golden state calls for insurance providers to electronically report insurance policy details to the DMV.If you need an SR-22, ask your insurance company to submit one in your place if it will. Some insurance provider do not file SR-22s - insurance.

Our evaluation of the cheapest insurance providers after a Drunk driving found that: California's five most inexpensive insurance firms raise annual minimum protection prices an average of $227., which intends to offer budget friendly insurance policy for motorists with one DUI on their documents, had the smallest rise in average price out of the team, adding just over $38 to the ordinary minimal rate for drivers with a DUI, at $725 a year or $60 a month.

The smart Trick of How Much Does Sr22 Cost In Illinois - Insured Asap That Nobody is Talking About

Because insurance firms utilize various factors to price rates, the most inexpensive insurer prior to an offense most likely will not be the most affordable after (sr22). Our evaluation discovered that while Geico had the most affordable average annual rate for an excellent vehicle driver with minimal protection, after a drunk driving the rate raised by greater than 150%, pushing the company out of the leading five most affordable firms for an SR-22 in The golden state.

Before you begin looking for inexpensive SR-22 insurance coverage in Georgia, you should know that SR-22 insurance policy does not in fact exist. An SR-22 is an order by a court or the state of Georgia to send out proof of insurance to the Division of Motorist Services (DDS). SR-22s aren't distinct. There are numerous others like it across Georgia as well as the united state

What is "SR-22 Insurance policy?"An SR-22 is evidence of insurance policy. It is usually called for after a driving offense, such as driving without insurance coverage or having also many at-fault crashes. In Georgia, an SR-22 can either be demanded by a court or the Georgia Division of Vehicle Driver Provider (DDS). To acquire an SR-22 in Georgia, you have to first locate an insurance coverage business prepared to deal with chauffeurs needing an SR-22.

The most usual factor plans are denied is a chauffeur's document., such as Geico or Progressive, are able to guarantee vehicle drivers in demand of an SR-22.

If you desire to maintain your permit as well as continue driving, you will require to ask your insurance coverage company to send out an SR-22 to the DDS immediately. If you do not have insurance coverage, you will need to find an insurance provider going to insure motorists looking for an SR-22 (liability insurance).

Upon conviction, a court will certainly order the motorist to pre-pay up to 6 months for minimum obligation for 3 years. Like an SR-22 it assures future protection, however it is more stringent since month-to-month repayments are not an option up until 3 years have actually expired. An FR-44 is likewise comparable to an SR-22 due to the fact that it, too, shows monetary obligation (for this reason the 'FR').

Sr-22 In California: What You Need To Know - Insurance for Beginners

When this is the situation, drivers are frequently gotten to buy double the state's minimum responsibility requirements. SR-50s are like SR-22s in that they confirm a chauffeur is carrying the mandated minimum obligation requirements stated by the state. Indiana requests SR-50s when a vehicle driver has had 2 relocating infractions within the very same year, a crash record has actually been submitted or vehicle driver has a relocating infraction after a taped DWI.

It, as well, is not insurance but instead evidence of insurance policy. With an SR-22, the motorist can please any commitments by making month-to-month settlements. With an SR-22A, drivers have to pay for insurance coverage six months in development, as well as they must do so for 3 years.

(Mon-Fri, 8am 5pm PST) for a of your SR22 Texas, or fill in this kind: Discover. What it is, that needs it, SR22 Texas Insurance coverage estimates, firms, contrasts, what it covers, how it works, uniqueness for Texas state, how to obtain SR22 cars and truck insurance coverage, renewal and/or expiration as well as far more.

While this might be true, there are many regarding why an individual might be anticipated to buy an SR22. SR-22 a kind of vehicle coverage. In fact, it is simply a file asked for with the (Department of Electric Motor Autos) that needs to be submitted and also accredited by utilizing a licensed car insurer.