Because insurance firms make use of various variables to price rates, the least expensive insurance provider before a violation possibly will not be the least expensive after - department of motor vehicles. In reality, our evaluation discovered that while Geico had the most inexpensive typical yearly price for a good motorist with minimal coverage, after a DUI the rate raised by greater than 150%, pushing the firm out of the leading 5 most inexpensive business for an SR-22 in The golden state.

For How Long Does SR-22 Last? This is a common concern that increases a great deal of issues amongst high-risk chauffeurs, yet it's vital to note that it won't last for life (driver's license). Exactly how long do you have to have an SR-22? It relies on your state, many call for that you maintain it for three years, however it can differ from one to 5. insurance.

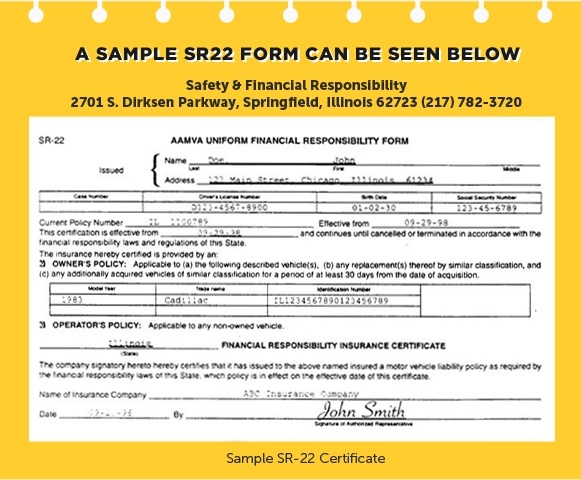

An SR-22 is a certificate of monetary duty required for some motorists by their state or court order. An SR-22 is not an actual "type" of insurance coverage, however a type submitted with your state - sr-22.

Do I require an SR-22/ FR-44? Not every person requires an SR-22/ FR-44. Rules differ from state to state. Generally, it is needed by the court or mandated by the state just for sure driving-related offenses. ignition interlock. As an example: DUI convictions Reckless driving Accidents triggered by uninsured chauffeurs If you require an SR-22/ FR-44, the courts or your state Automobile Division will notify you.

Existing Clients can call our Customer support Department at ( 877) 206-0215 - underinsured. We will certainly evaluate the coverages on your plan and start the procedure of submitting the certification on your behalf - insurance group. Exists a cost related to an SR-22/ FR-44? Most states bill a level cost, but others call for a surcharge. This is an one-time cost you need to pay when we submit the SR-22/ FR-44.

Some Known Incorrect Statements About How Long Does An Sr-22 Last? - Insurance Panda

A declaring charge is charged for every specific SR-22/ FR-44 we file. If your partner is on your policy as well as both of click here you need an SR-22/ FR-44, then the declaring fee will certainly be charged twice. Please note: The fee is not consisted of in the price quote since the filing fee can differ.

Your SR-22/ FR-44 ought to be legitimate as long as your insurance plan is active. If your insurance coverage plan is terminated while you're still required to bring an SR-22/ FR-44, we are called for to alert the appropriate state authorities. driver's license.

Greet to Jerry, your brand-new insurance policy representative. We'll call your insurance coverage company, examine your current plan, then discover the insurance coverage that fits your requirements and also conserves you money (department of motor vehicles).

sr22 sr22 insurance insure ignition interlock insurance

bureau of motor vehicles auto insurance deductibles insurance insurance companies

bureau of motor vehicles auto insurance deductibles insurance insurance companies

The cost of SR-22 insurance policy is typically considerably more than the price of typical car insurance coverage, as insurance policy holders with past driving offenses are taken into consideration high-risk to insure. Just how do I get SR-22 insurance policy protection in Wisconsin? To obtain SR-22 insurance coverage in Wisconsin, you will require to collaborate with a vehicle insurance business accredited to do company in the state.

If you're filing an SR-22 form as an under-18 vehicle driver, allow the insurer know the filing remains in lieu of sponsorship, suggesting that you're applying for protection to drive under the age of 18 without a moms and dad or guardian as an enroller. When your insurer files the SR-22 type on your part, it will usually charge a flat charge between $15 as well as $50.

The 2-Minute Rule for What Is Sr-22 Insurance And Who Needs It? - Credit Karma

underinsured insurance insurance car insurance liability insurance

underinsured insurance insurance car insurance liability insurance

division of motor vehicles deductibles deductibles vehicle insurance credit score

division of motor vehicles deductibles deductibles vehicle insurance credit score

Online submitted SR-22 certifications ought to be shown on your driving document within a few company days. Upon refining the SR-22 type, the DMV must send you a letter confirming evidence of insurance protection and that you are legally eligible to drive again - no-fault insurance. The length of time is SR-22 insurance policy protection required in Wisconsin? In Wisconsin, vehicle drivers are needed to hold SR-22 insurance filings for 3 years from the day their licenses are qualified to be reinstated (dui).

To locate the most inexpensive price for SR-22 insurance policy in Wisconsin, we advise for SR-22 quotes from several insurers (insurance companies). Insurer analyze threat differently and also bill different prices as necessary, so looking for several quotes is typically the very best technique to find inexpensive SR-22 insurance policy. deductibles. We also recommend making inquiries concerning potential price cuts, as vehicle drivers are frequently qualified for price decreases based on their automobile type, driving document, involvement in a protective driving training course, being a good trainee and much a lot more.

In Wisconsin, all vehicle drivers under age 18 are needed to have an enroller to acquire a motorist's license or teacher's authorization. Severe driving violations such as DUIs or Duis (driving while inebriated or impaired), hit-and-runs or negligent driving can result in retraction or suspension of a vehicle driver's permit, along with the demand for a work certificate.